5 Things You Need to Know about Mobile Financial Services

On January 18, 2018, the Wireless Technology Forum held their 7th annual panel discussion on Mobile Financial Services. The inaugural panel in 2012, moderated by Dr. Phil Hendrix, predicted a revolution in the way consumers would conduct financial transactions with mobile. While the mobile commerce journey was full of ups and downs, mobile financial services is here today.

Here are 5 things you need to know about Mobile Financial Services.

1. You’re probably already using Mobile Financial Services whether you know it or not.

Have you ever…

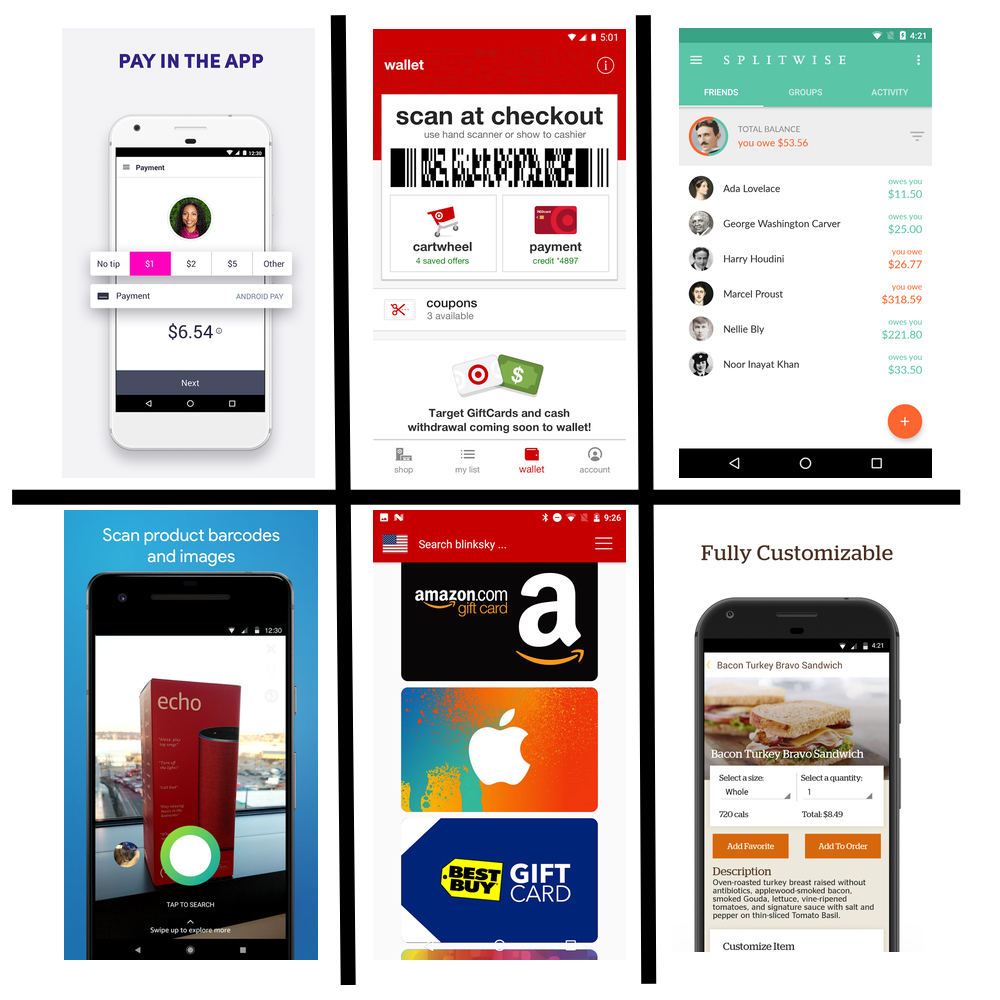

- ‘Called’ an Uber of Lyft?

- Ordered ahead with a mobile app at Starbucks, Chick-fil-a, Panera, or a variety of quick serve restaurants?

- Found a lower price on Amazon (while in the store) and then bought the item on the Amazon app?

- Redeemed a mobile coupon at Kroger or Target?

- Sent money or spilt a bill with friends with a mobile app?

- Bought a Groupon, or gift card from BlinkSky on your smartphone?

If you answered yes, to any of the above questions, you are using Mobile Financial Services.

Forget using your phone at retail point-of-sale, your phone is the Point-of-Sale. This is not a new concept, in 2014, Deloittle predicted that mobile financial services would raise the bar on customer engagement.

Mobile is not always the center of the transaction, but mobile is the link or ancillary component to many financial transactions today.

2. Mobile can enable cash payments (yeah, real paper cash).

Many Americans today are “unbanked,” meaning that they don’t have a bank account or credit card. For these consumers, paying utility bills requires a trip to the power company, phone company, water company, and more. David Elve and PayGo have found a way to enable mobile financial services for the unbanked by creating an app that allows the unbanked to pay for their utilities with paper cash at 200,000 retail locationsincluding Dollar General.

3. Challenges to Mobile Financial Services – Changing consumer behavior is difficult.

Spencer White, revealed insights from his days at Softcard (formerly and ironically known as Isis) on how difficult it was to change customer behavior from card swiping to tapping or hovering with mobile. Esther Pigg, FIS, chimed in about consumer’s “lack of trust in new technology.” Both Esther and Spencer faced steep objections from consumers around security, but these same consumers’ eyes glazed over when technology companies explained that mobile payments are actually more secure than traditional swiping. At the end of the day, it was expensive financial incentives that finally moved the needle in point-of-sale mobile commerce. Spencer provided the specific example of offering $50 in free mobile accessories to acquire a customer at Softcard.

4. Mobile Financial Services is coming to B2B.

According to Esther Pigg, FIS, consumer behavior drives business transactions, and ACH is slow. In today’s ‘NOW’ economy, many vendors will pay a few fees to accept an app for faster payment. B2C is an interesting area of opportunity in the personal insurance arena. In the near future, insurance adjusters could become empowered to issue immediate insurance claims to consumers at the point of inspection.

5. What is the future of mobile financial services?

The panel unanimously predicted a shift from mobile to IoT (Internet of Things) commerce.

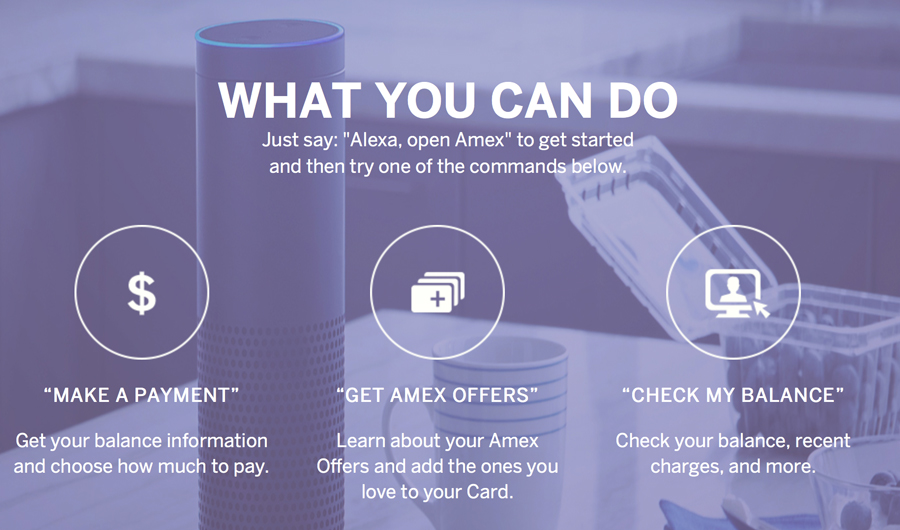

Typical interaction of the future:

User: “Alexa, pay my utility bill.”

Alexa: “Which type of payment would you like me to apply?”

User: “My Visa card.”

Alexa: “Your utility bill has been paid.”

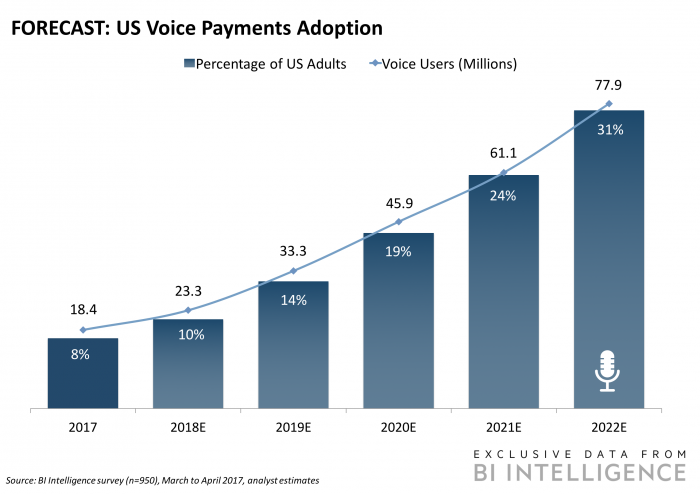

Business Insider predicts that voice payments will reach 31% of US adults by 2022.

American Express has already enabled payments, offers, and balance in their Amex Alexa Skill. BrandChannel predicts that voice interaction will appeal to Gen Y and Gen Z; As the population ages, the spending power will migrate to the hands of our youth.